CBS News Live

CBS News Colorado: Local News, Weather & More

Watch CBS News

A jury failed to reach a decision on whether Andrew Buen, the former deputy who shot Christian Glass several times, is guilty of second-degree murder.

Former Colorado paramedic Jeremy Cooper was sentenced to four years probation, 14 months work release and 100 hours of community service on Friday afternoon.

A fire heavily damaged a house in Aurora. It happened on the 1800 block of South Truckee Way, which is in the Aurora Highlands neighborhood.

Approximately 40 pro-Palestinian protesters on the Auraria Campus in downtown Denver were arrested on Friday afternoon.

Donors are being honored during the month of April along with their families who agree to donate an organ, eye, and tissue.

Certified lab results show the water system's black sludge is filled with radioactive lead and uranium.

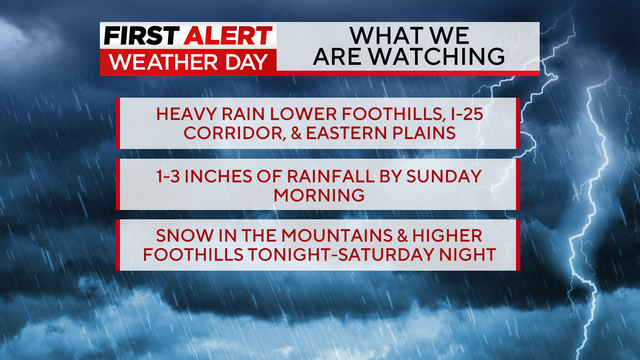

Get your raincoat ready and grab that umbrella as much needed moisture arrives tonight into the weekend.

In the 70s, it was a place where Chicanos would gather and catch Spanish-American films, then in the late 80s the theatre became a space for live shows and concerts.

Film on the Rocks also includes live performances along with the beloved films under the stars at the iconic Red Rocks Park & Amphitheatre.

Watch meteorologist Callie Zanandrie's forecast.

Quarterback Bo Nix arrived in Colorado on Friday and spoke to reporters at Denver headquarters. The first round draft pick said he's excited to be in Broncos Country.

The Denver Broncos selected quarterback Bo Nix with No. 12 pick in first round of NFL Draft.

An unprecedented six of the first 12 picks were quarterbacks, an NFL Draft record.

Some 10,000 teachers, parents and students traveled across four states to Coors Field for STEM Day, to bring their love of science to life.

The Denver Nuggets superfan who has been banned from games at Ball Arena has filed a lawsuit against Kroenke Sports and Entertainment.

Approximately 40 pro-Palestinian protesters on the Auraria Campus in downtown Denver were arrested on Friday afternoon.

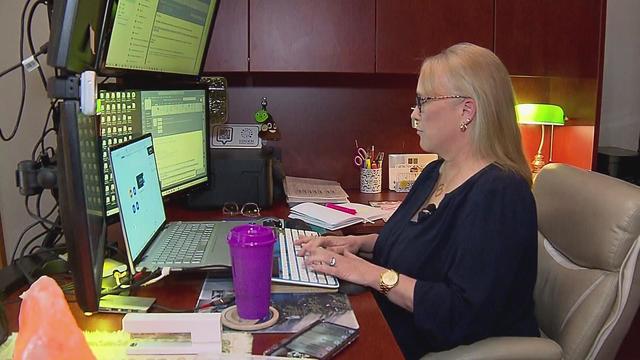

The CEO of Tandem Resource Solutions started the company as a side hustle. Second Act Women was one of the groups that helped her along the way. Second Act Women is hosting BizLifeCon this weekend.

Denver Public Schools hosts Shakespeare Festival at the DCPA complete with 17 stages to showcase the adaptations of the bard's work.

In Centennial, students are building tiny homes to help the unhoused in Denver.

This is the first affordable housing development in Lyons since the devastating floods of 2013.

The White House had been due to decide on the menthol cigarette rule in March.

"I am happy to debate him," President Biden said during an interview with Howard Stern.

Secretary of State Antony Blinken has been weighing whether to recommend suspending U.S. aid to an IDF unit under a measure known as the Leahy Law.

Trump has in the past railed against absentee voting, declaring that "once you have mail-in ballots, you have crooked elections."

President Biden finds familiar and active allies for his reelection bid with labor union endorsements.

Certified lab results show the water system's black sludge is filled with radioactive lead and uranium.

CBS News Colorado spoke with two Department of Corrections employees who asked to remain anonymous but sounded the alarm on the issue in March.

Families of people with long-term disabilities allege dysfunction and chaos within Colorado's Medicaid offices are failing the state's most vulnerable populations.

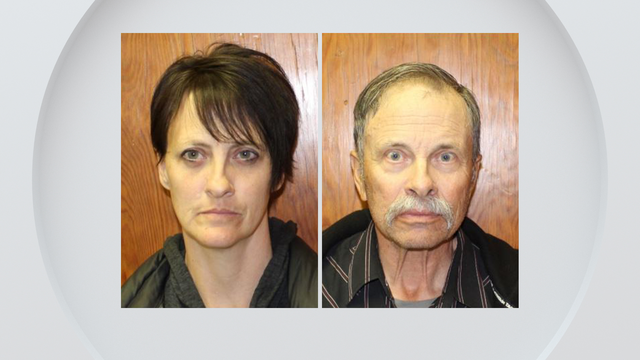

Two more family members have been arrested and charged with abuse of a developmentally disabled man in their care. Witnesses say they beat, choked, kicked and punched a relative who functions at the level of a 5- to 8-year-old.

A 65-year-old Colorado woman appears to be the latest victim of a widespread romance scam known as the "Keanu Reeves Scam."

Around 1 in 5 retail milk samples had tested positive for the bird flu virus, but further tests show it was not infectious.

The White House had been due to decide on the menthol cigarette rule in March.

The discovery of drug-resistant bacteria in two dogs prompted a probe by the CDC and New Jersey health authorities.

Donors are being honored during the month of April along with their families who agree to donate an organ, eye, and tissue.

First known HIV cases from a nonsterile injection for cosmetic reasons highlights the risk of unlicensed providers.

Just four months into the year, more than 7,400 people have applied for Denver's rental assistance program, TRUA.

Many families who are newcomers to Denver are still struggling to find stability with housing and food.

Josh Scott is using his problem-solving skills to try to help schools absorbing large numbers of students from the southern border.

The organization Eye Love Care is helping McMeen Elementary School students with free eye exams.

A dentist and hygienist visited McMeen Elementary to educate the students about the importance of dental hygiene.

A jury failed to reach a decision on whether Andrew Buen, the former deputy who shot Christian Glass several times, is guilty of second-degree murder.

Former Colorado paramedic Jeremy Cooper was sentenced to four years probation, 14 months work release and 100 hours of community service on Friday afternoon.

A fire heavily damaged a house in Aurora. It happened on the 1800 block of South Truckee Way, which is in the Aurora Highlands neighborhood.

Approximately 40 pro-Palestinian protesters on the Auraria Campus in downtown Denver were arrested on Friday afternoon.

Donors are being honored during the month of April along with their families who agree to donate an organ, eye, and tissue.

Approximately 40 pro-Palestinian protesters on the Auraria Campus in downtown Denver were arrested on Friday afternoon.

The CEO of Tandem Resource Solutions started the company as a side hustle. Second Act Women was one of the groups that helped her along the way. Second Act Women is hosting BizLifeCon this weekend.

Denver Public Schools hosts Shakespeare Festival at the DCPA complete with 17 stages to showcase the adaptations of the bard's work.

In Centennial, students are building tiny homes to help the unhoused in Denver.

This is the first affordable housing development in Lyons since the devastating floods of 2013.

Quarterback Bo Nix arrived in Colorado on Friday and spoke to reporters at Denver headquarters. The first round draft pick said he's excited to be in Broncos Country.

The Denver Broncos selected quarterback Bo Nix with No. 12 pick in first round of NFL Draft.

An unprecedented six of the first 12 picks were quarterbacks, an NFL Draft record.

Some 10,000 teachers, parents and students traveled across four states to Coors Field for STEM Day, to bring their love of science to life.

The Denver Nuggets superfan who has been banned from games at Ball Arena has filed a lawsuit against Kroenke Sports and Entertainment.

Under the new law signed this week, ByteDance has nine to 12 months to sell the platform to an American owner, or TikTok faces being banned in the U.S.

Around 1 in 5 retail milk samples had tested positive for the bird flu virus, but further tests show it was not infectious.

About 7 in 10 retirees stop working before they turned 65. For many of them, it was for reasons beyond their control.

The White House had been due to decide on the menthol cigarette rule in March.

The discovery of drug-resistant bacteria in two dogs prompted a probe by the CDC and New Jersey health authorities.

The White House had been due to decide on the menthol cigarette rule in March.

"I am happy to debate him," President Biden said during an interview with Howard Stern.

Secretary of State Antony Blinken has been weighing whether to recommend suspending U.S. aid to an IDF unit under a measure known as the Leahy Law.

Trump has in the past railed against absentee voting, declaring that "once you have mail-in ballots, you have crooked elections."

President Biden finds familiar and active allies for his reelection bid with labor union endorsements.

Around 1 in 5 retail milk samples had tested positive for the bird flu virus, but further tests show it was not infectious.

The White House had been due to decide on the menthol cigarette rule in March.

The discovery of drug-resistant bacteria in two dogs prompted a probe by the CDC and New Jersey health authorities.

Donors are being honored during the month of April along with their families who agree to donate an organ, eye, and tissue.

First known HIV cases from a nonsterile injection for cosmetic reasons highlights the risk of unlicensed providers.

Under the new law signed this week, ByteDance has nine to 12 months to sell the platform to an American owner, or TikTok faces being banned in the U.S.

About 7 in 10 retirees stop working before they turned 65. For many of them, it was for reasons beyond their control.

First known HIV cases from a nonsterile injection for cosmetic reasons highlights the risk of unlicensed providers.

In the 70s, it was a place where Chicanos would gather and catch Spanish-American films, then in the late 80s the theatre became a space for live shows and concerts.

A new rule will affect frozen breaded and stuffed raw chicken products that appear to be fully cooked but are only heat-treated.

Eating a healthy, balanced diet when money is tight can be tough. And it's no secret that food costs have skyrocketed within the past year. According to the U.S. Department of Agriculture, food costs in 2023 rose 5.8%.

A Denver nonprofit that works with communities to plant trees and improve parks is having a special giveaway, providing trees for free and at a discount.

You've probably noticed recently the amount or quantity in a package of food or house supplies is decreasing, while the price is increasing.

Receiving a phone call with information saying it's your loved one on the other line can be harmless. However, it could be part of an elaborate plan from a scammer.

Inflation is cooling right now, but the prices of groceries and food are still rising. For example, the latest CPI data shows that grocery store prices are 25% higher than in January 2020.