How Coronavirus Toilet Paper Shortage Could Help Reshape Global Supply Chain

DENVER (CBS4) - Grocery store workers across America continue putting in long hours as they work to keep store shelves stocked and ready to go during the COVID-19 pandemic. But no matter what store you go to there is one aisle that seems it will forever be empty -- the toilet paper aisle.

So what is the solution to this problem? One professor at Colorado State University has been spending a lot of time thinking about this problem, and what it takes to get things from Point A to Point B. He says the answer to our lack of toilet paper is simple.

"Toilet paper is big, it takes up a lot of space, but it's not very valuable," says Zac Rogers, an assistant professor of operations and supply chain management in CSU's College of Business.

For shipping to be cost effective a toilet paper company will wait until they have enough orders to send a truck that is fully packed. Because of that, you wouldn't send toilet paper every day. You'd probably send two or three big trucks once a week, Rogers explained.

The demand being created by bare shelves at grocery stores means big business for the transportation industry, but it also means big changes. In the case of toilet paper it means that companies need to send larger shipments more frequently.

Rogers, a former operations manager at Amazon, is co-founder of a tool called the Logistics Managers Index, which is used to track inventory, warehousing and transportation. It looks specifically at the supply chain and generates a glimpse of a sector of the economy that is unique from other models. Recent data from the LMI was surprising to Rogers.

"If you just look at GDP, all that tells you is what already happened," Rogers said. "Whereas, if you look at transportation and inventory, when transportation goes up, that tends to mean, OK, we're moving a lot of goods forward because we think we're about to have more sales."

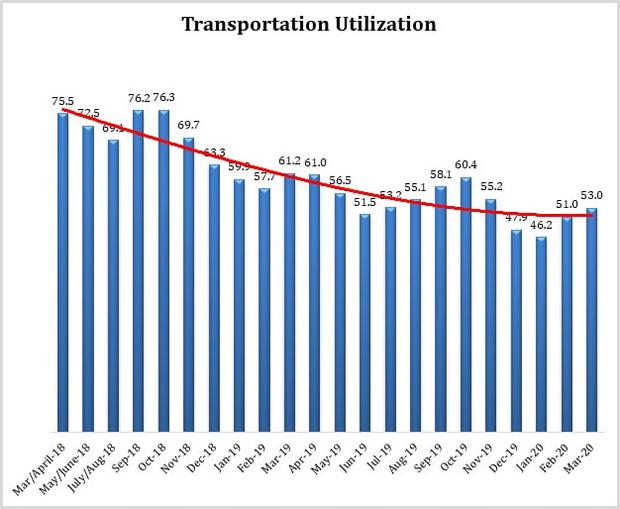

Rogers says the LMI indicates how the transportation industry has been working hard to fill the huge demand coming from retailers and big-box stores like Walmart and Target. The number of trucks available to transport goods was down in March, the lowest since October 2018.

But on the flip side the amount of space being utilized in trucks has increased, according to Rogers. That means trucks are being packed full of products that we want and need, including things like disinfectant, nonperishable goods and toilet paper.

The LMI tool that Rogers helped create tracks month-over-month changes in the capacity of transportation and utilization in addition to other things like the cost of transportation. Rogers says values of less than 50 show contraction while values greater than 50 show growth.

Toilet paper depends on operations in the United States, unlike other goods such as clothing and electronics, which ship from overseas.

"If the international supply chain is closed for too long," Rogers explained, "then we will run into big issues. If it's only a matter of essentials, consumers will be OK."

In the wake of coronavirus shipments from China drastically decreased. The port of Los Angeles, which would normally see about 12 cargo ships per day, only receives about four now, Rogers said.

It usually takes a cargo ship about a month to reach the United States once it leaves China. Because of this, just as the United States started to see a reduction in imports, demand from consumers rose sharply from concern over the coronavirus.

"We're kind of getting hit from two sides," Rogers said. "We have increased consumer demand at home and decreased international input coming into the west coast from China."

While no one knows what the short-term future looks like, Rogers says he is impressed by the national supply chain's ability to function and even grow, even in the middle of the COVID-19 outbreak.

"I think the supply chain is very resilient," he said. "In many ways right now it's been the most resilient part of the economy."

The latest LMI report from March 2020 shows that a nearly two-year trend of the index decreasing has reversed. And while the spike in logistics activity may not last, for the time being, it shows the resiliency of the industry.

"There's still economic activity going on, it's just shifted," Rogers said. "And that shift has leaned pretty heavily on the supply chain and on transportation specifically."

A strong logistics industry means economic activity, at least in some sectors, can still take place.

GOOD QUESTION: https://denver.cbslocal.com/2020/04/10/good-question-toilet-paper/