Coloradans Reacting To Higher Health Insurance Costs

AURORA, Colo. (CBS4)- Many Coloradans are feeling sticker shock as they receive notices of what their health insurance will cost next year. A new law that took effect earlier this year did result in rates dropping for everyone who buys their insurance on the exchange. But tax credits - that help offset insurance for lower income Coloradans - dropped even more.

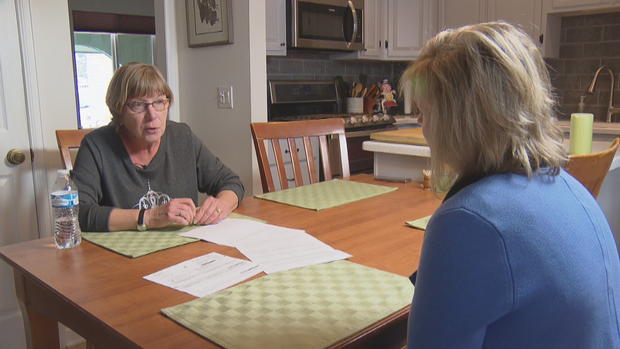

That's resulted in a net increase in costs for tens of thousands of people who make the least amount of money, like Carol Downs of Aurora. When she got a note in the mail showing an increase of almost 35%, nearly $80 a month, in her health insurance costs next year - she panicked.

"We're on fixed and limited income. That's a week's groceries. You combine it over a year, that's a whole mortgage payment," said Downs.

Under the new law, the state helps pay some of the most expensive claims so insurance companies can lower rates for everyone - regardless of income. But that triggers a greater reduction in tax credits for the lower income.

"I'm really frustrated in how this has been sold to Colorado. There were press conferences talking about how insurance costs in Colorado were going to go down 18% and although that may be true for a very small slice of Coloradans, generally speaking, people who purchase their insurance on the exchange and receive a subsidy, are seeing their rates go up a ton and these are the people I feel most need help from the government," said Sen. Jim Smallwood, a Republican representing Douglas County.

Smallwood warned the state Legislature last spring about the unintended consequences to no avail, "If the administration wasn't aware that this was going to be the result, of this bill, then I would say there is some incompetence there. And if they did know and withheld it from the legislature and the people, then it's just unconscionable."

Gov. Jared Polis' office wouldn't comment, directing questions to the state's Division of Insurance. Their advice to those like Downs is to shop around for cheaper plans.

She said she has, "The options I have that keep me in the same price range, don't include my doctor. They have higher out-of-pocket expenses. They don't cover the same things. When the session opens in January, I'll be there, they'll hear from me."

The new law especially helps people who don't qualify for subsidies and live in areas like resort towns where insurance rates have been among the highest in the country.

But for nearly 80% of the people on the exchange, who live along the Front Range, and do qualify for tax credits - they may see their costs will go up 20%, 30%, even 40% in some cases unless they shop around for a less expensive plan.