Netflix Fights Sales Tax Bill In Loveland

By Jeff Todd

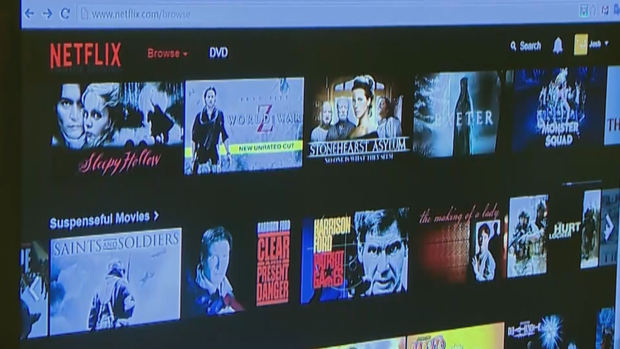

LOVELAND, Colo. (CBS4) – Netflix is fighting the City of Loveland over sales taxes.

Loveland sent the company a bill for $116,508.22 in September 2016. Netflix fought the bill, but never heard back from the city, so the two are now fighting in district court.

Netflix says its streaming services aren't subject to sales taxes. The company argues only tangible property, like its DVD rentals, are subject to a tax.

"In order for the City to tax the rental of DVDs, the DVD customer must both obtain possession or control over the DVDs and the DVDs must be located in the City," the complaint filed by Netflix stated. "However, Streaming Service subscribers do not obtain possession of or control over any video content or tangible personal property, and none of such content or any property involved in the Streaming Service was located in the City."

The City of Loveland, just last week, rescinded the outstanding balance and is leaving it up to the state to decide what should be taxed.

"The State Department of Revenue should be the entity clarifying the law around what is or is not tangible personal property subject to taxation, especially in an emerging arena of digital goods," court documents from the Loveland Assistant City Attorney Alicia Calderon stated.

Netflix says it is protected from the federal Internet Tax Freedom Act and says the state has no say in implementing a tax on streaming content.

Jeff Todd joined the CBS4 team in 2011 covering the Western Slope in the Mountain Newsroom. Since 2015 he's been working across the Front Range in the Denver Headquarters. Follow him on Twitter @CBS4Jeff.