Federal Reserve To Buy Mortage-Backed Securities To Spur Job Growth

DENVER (CBS4) - You may have heard a lot about that move by the Fed to try and shore up the economy, but how does it work and what does it mean to you?

The Fed says it will buy $40 billion a month of mortgage-backed securities to spur economic growth. The Fed hopes to encourage businesses to hire more.

It's called "quantitative easing," meaning that the Fed will buy the bonds until the job market improves.

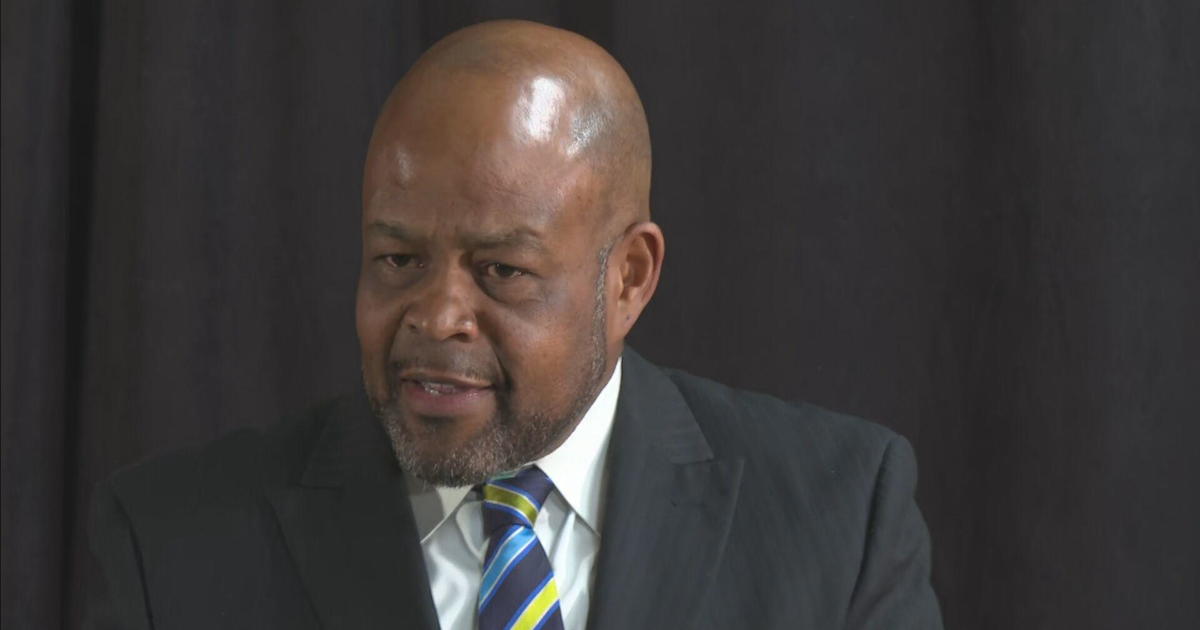

"What the Fed will be doing is basically expanding their balance sheet, which means creating money and pumping it into the economy," Edward Jones financial advisor David Cooper said.

But some analysts fear it could push up oil and gas prices.

"If we're spending more money at the pump to fill up our cars, that's less money we have to go out to eat ... to take our kids shopping," Cooper said. "So that could definitely have a very negative effect on the overall economy."

The move by the Fed could also impact the presidential election.

"A lot of people vote based on what their 401k and their IRA statements look like," Cooper said. "This announcement has had a very positive effect on the stock market, and if it causes people's account balances to go up, they might tend to vote more for the person currently in office."

Another reason why the move by the Fed is so controversial is that it's open-ended. Fed Chairman Ben Bernanke has said the Fed is going to do it until the economy improves.