Mortgage Modification Comes With Credit Consequences

FORT COLLINS, Colo (CBS4) Thousands of homeowners have benefited from the government and bank loan modification programs. They've received lower monthly payments, but they found later, that the modification had a negative affect on their credit and that they'd be paying more for some of their other bills.

Arnold Rodriguez was one of those lucky homeowners who was approved for a mortgage modification. The new lower payments allowed him to stay in his Fort Collins condominium. He got the modification in 2009, but to qualify he ended up missing several monthly mortgage payments.

"During the modification program, that was one of the stipulations that you had to have missed a few payments," Rodriguez told CBS4.

In addition to missed payment, Rodriguez also paid a modified monthly payment for a trial period while the modification paperwork was processed. Again apart of the application process. What Rodriguez wasn't expecting was that all the missed and modified payments showed up on his credit report.

"My credit rating is pretty bad just because of that," he explained.

Bad credit means higher premiums. Rodriguez just got notified that his car insurance is going up.

"It's counter productive. These modifications were supposed to help people and they're going to ruin their credit in the process?" Rodriguez said.

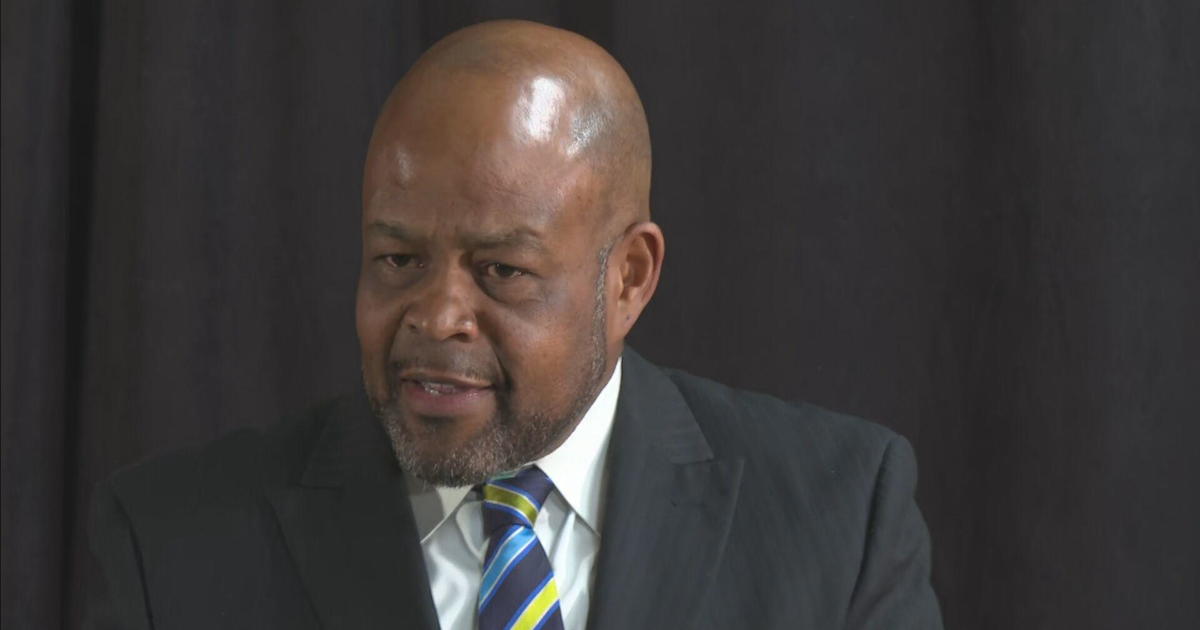

University of Denver business professor Ron Throupe says it's not surprising that a modification would cause credit problems.

"Even inquiries can show up on your credit regardless of actual action," Throupe said.

Mortgage companies are required to report any missed or partial payments. But for homeowners already in financial crisis, this can be an unexpected and unwanted outcome.

"I don't see why my bank needs to do more to try to hurt me when I'm making good on the modification," Rodriguez added.

Throupe suggest keeping a close eye on your credit report. It could take 5 to 7 years before those missed payments drop off your credit. You can contact your mortgage company and see if they'll work with you on cleaning up your credit, but they are not compelled to do that.

-- Written for the Web by CBS4 Special Projects Producer Libby Smith