Woman Takes Mortgage Company To Court; Wins $400,000 At Trial

PARKER, Colo. (CBS4) - A woman in Parker wins big after taking her mortgage company to court.

A federal jury found the lender "willfully" and "negligently" sent false information to the credit bureaus.

Valerie Jeffers has lived in her home east of Parker with her two girls her entire life; it is filled with more than two decades worth of holidays, birthdays & memories.

"I raised my kids in that home," Jeffers said.

In 2010, she found herself filing for bankruptcy.

"They stuck a foreclosure notice on my home, and I thought 'I want to save my home. I don't care. I just want to save my home,'" she said.

After four years of working two, sometimes three jobs, she was discharged from bankruptcy.

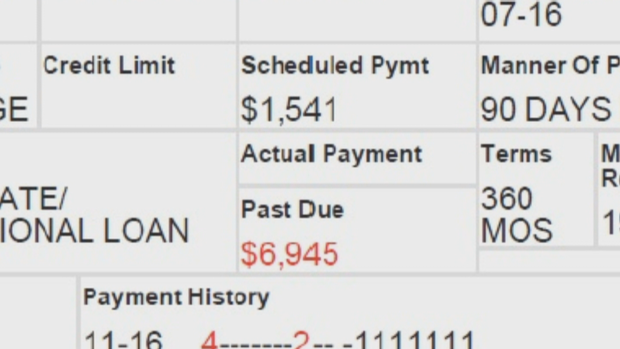

A month later, her mortgage company, Ocwen Loan Servicing, started sending her past due notices. They claimed she still owed more than $6,000.

"I thought 'I cannot do this. This isn't right. I don't owe them anything, and I've got to find a way to fight it,'" Jeffers said

She hired attorney Matt Osborne who filed a lawsuit. The case ended in a settlement requiring Ocwen to show the loan was current and always had been.

Ocwen, it appeared, never updated their records, and when Jeffers filed dispute after dispute, they brushed her off.

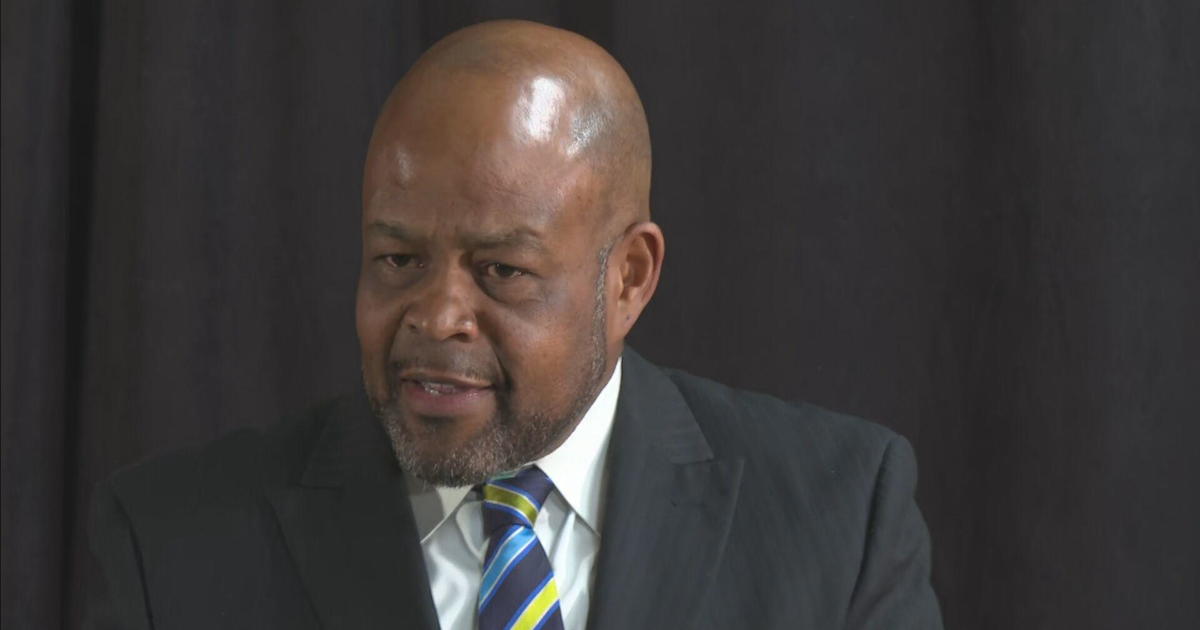

"Ocwen didn't do anything to investigate it. They outsourced it to India. They kind of processed it like a factory line," Osborne said.

Federal law requires a thorough investigation into every dispute, setting the stage for Osborne to file a second lawsuit.

"My feeling is they had my life in their hands, and they had my life in their hands for several years, and they never fixed it. That's scarier than going to trial," Jeffers said.

A jury found Ocwen ignored her concerns and instead continued to file false claims with the credit bureaus.

As a result, they are now paying Jeffers more than $400,000 for her trouble.

Jeffers hopes anyone caught in similar circumstances will hear her story and decide to fight

"If I can help one person, if I can help one person out there that's all I care about," she said.

Osborne who specializes in false credit reporting cases in Colorado says as far as he knows this is the first case of its kind.

Karen Morfitt joined the CBS4 team as a reporter in 2013. She covers a variety of stories in and around the Denver metro area. Connect with her on Facebook, follow her on Twitter @karenmorfitt or email her tips.