Credit Card Security Top Of Mind This Holiday Shopping Season

DENVER (CBS4) - Major computer breaches over the last year have made millions of credit card accounts vulnerable to thieves. Now the scramble is on to get more secure technology in the hands of American shoppers.

Newest on the markets is Apple Pay, which allows you to keep your credit and debit cards on your phone. Then at participating retailers, you can hold your phone up to the terminal and the payment is made automatically using a temporary number called a "token." The token number becomes invalid seconds after the purchase goes through. Google Wallet is the Android version of this technology.

"The token is coming right back to verify that the card being presented is actually real," said Steve Fox, a cyber security expert with Security Pursuit.

Fox says the token system is beneficial for protecting against fake cards, but it still may be vulnerable.

"In the next three years, you'll hear about an Apple Pay breach," Fox told CBS4.

Apple Pay and Google Wallet are still too new to be widely used. Right now, there are 220,000 retailers who've agreed to accept phone payments, not enough to make the technology common place. Credit and debit cards are still, by far, the most common form of payment.

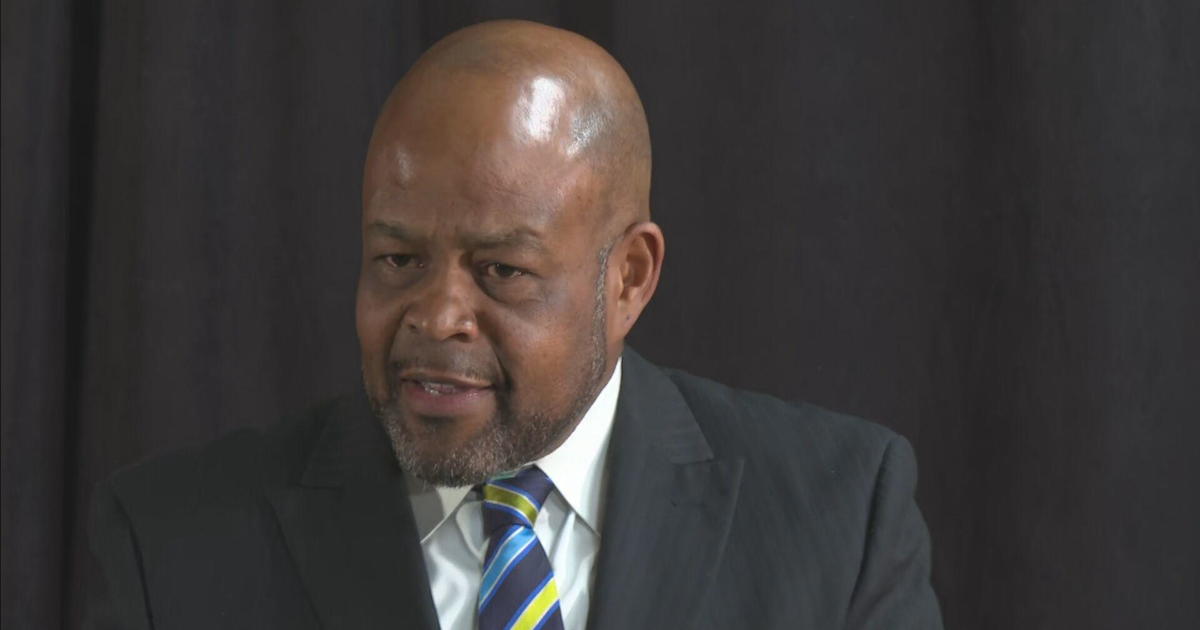

Steve Montross is the head of CPI Card Group, one of the largest makers of credit cards in the nation. He says his business has tripled in the last year as financial institutions move to "chip and pin" cards.

"It really cuts down on counterfeit fraud tremendously because the information that's on that card is encrypted on that chip and so it's not possible for the fraudster to take that information off the chip and then create a duplicate card," Montross told CBS4.

Card companies are scrambling to replace magnetic strip cards with cards that have the more secure chip technology and require a pin number for verification. These cards have been used for years in Europe and have reduced fraud up to 80 percent. The United States has been slow to make the transition.

"The card brands and financial institutions have chosen to accept the risk instead of spending the money to move over to these secure chip and pin systems," Fox said.

Even with chip-and-pin technology, your account information is still on a server, and therefore could be vulnerable. Security experts say the only sure way to protect your credit is to use cash.

--Written for CBSDenver.com by Special Projects Producer Libby Smith