Health Plan Founder Faces Money Laundering Charges

DENVER (CBS4) - A federal grand jury has indicted the founder of a company that provided health care coverage for some 4,000 customers in three states.

DENVER (CBS4) - A federal grand jury has indicted the founder of a company that provided health care coverage for some 4,000 customers in three states.

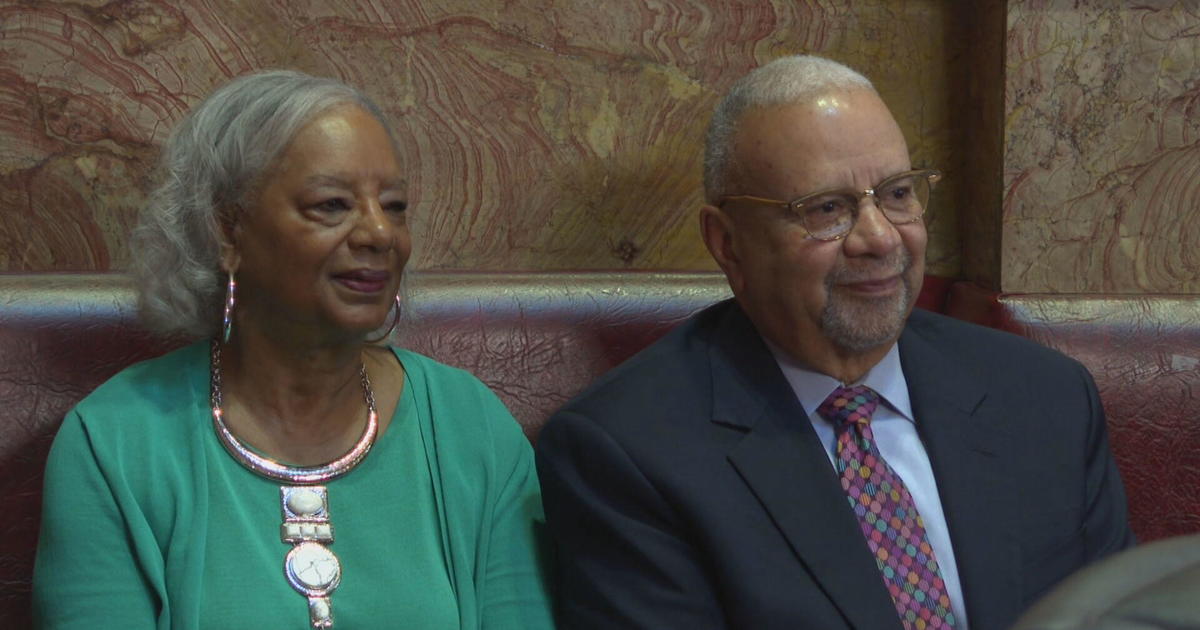

Gerald "Gerry" Rising, 59, who headed Rural Health Plans Initiative Administration Company in Centennial, faces up to 20 years in prison if convicted.

A federal grand jury accuses Rising of embezzling tens of thousands of dollars from his company and leaving his customer's with huge unpaid medical bills.

The case involves some 4,000 customers, including employees of school districts in Colorado and two other states, plus employees of many small businesses.

When Barbara Brom broke her elbow she thought her extensive medical bills were covered. She found out otherwise.

"It was a constant battle daily to get them to pay even the smallest bill, even to an

urgent care," she said.

The home healthcare company Brom works for, Best Care, had arranged for employee insurance through the Rural Health Plans Initiative Administration. CBS4 showed the indictment to Anna Zarlengo, the president of Best Care.

"I think it's wonderful; I'd like to see the man go to prison," Zarlengo said.

Zarlengo had five surgeries for breast cancer and knee problems with $130,000 in claims herself. Thirteen of her employees also had claims under the plan through her company. She said they chose Rural Health Plans Initiative for financial reasons.

"We decided that this would be the best price for our self and our employees."

But Rural Health Plans Initiative not only failed to pay a great deal of the claims, it went bankrupt.

The way the company was set up it did not fall under the scrutiny of the Colorado Division of Insurance. Cameron Lewis is Director of Consumer Education for the division. She offered advice.

"If you feel great benefits for little money, it's of concern," Lewis said. "You might want to look into it further."

Now Rising faces charges of mail fraud, money laundering and theft. Brom was pleased.

"I'm glad to hear that and I hope he's punished; I do," Brom said.

Some of Brom's medical bills were forgiven by the hospital involved, but she still owes $10,000, which she has to pay off at the rate of $100 a month for the next 8 years.

CBS4 attempted to reach Rising by phone and a visit to his most recent Denver area address, but received no reply.

"As the indictment alleges, employees and companies trusted the defendant to take care of a vital matter – their health care insurance coverage. He took their money, but betrayed that trust, and will now face the consequences of his actions," U.S. Attorney John Walsh said.

Sean Sowards, Special Agent in Charge of the IRS Criminal Investigation Denver Field Office said, "Crimes like this are motivated purely by greed and the plan beneficiaries are the real victims in this case."