Expert Offers Advice On How Much College Debt To Take On

DENVER (CBS4) - Rising tuition will have more students seeking college loans, which can be overwhelming and intimidating. So how much debt should be considered when it comes to choosing a college? CBS4 wanted to find out.

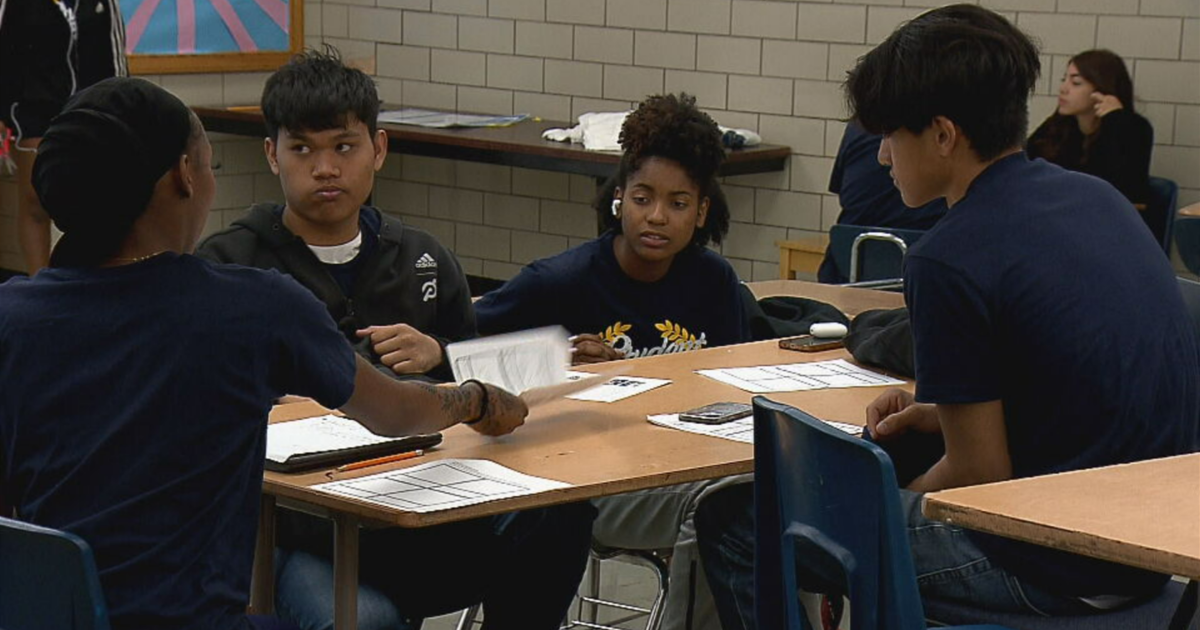

Caught up in the college crowd is Carson Byerhof and Gabrielle Richardson – both high school juniors. They're taking college courses so they can skip the required classes later.

When it comes to college debt, Richardson said, "It terrifies me, it's really scary to think about how much I'm going to owe."

Just mention student loan debt on Metro State's Campus and most everyone has it.

"Already I'm about $10,000 in debt," college student Isaac Baskerville said.

And he said he's only been in school about a month.

Alana Stevenson, also a college student said, "You just build it up so fast. After 4 or 5 years of college you're in $50,000 worth of debt."

So how much debt should a college student take on? It depends, according to certified financial planner Jennefer Walsh.

"It's important to look at the earning potential of your occupation," Walsh said.

One rule of thumb to follow is the total debt for a 4-year degree should not be more than what a person likely will earn their first year working in their field. And when it comes to paying off loans, Walsh said, "Student loan debt repayment should only be a maximum of 8 percent of your monthly income."

So let's say a total student loan is $25,000 to be paid off in 10 years plus interest. The monthly payment would be about $288. To pay off a maximum of 8 percent a month means the minimum salary needs to be $43,200. And in this economy, that's a lot of money right out of school.

Carson Byerof, a high school junior said, "I'm not so sure I can jump into a job and still have these student loans behind you."

The best advice comes from students already in debt.

"Make up your mind what you want and stick with it," Baskerville said.

"(Get) good grades in high school so you can get scholarships all the way through and not have to pay anything," Stevenson said.

When it comes to managing student loan debt, consider all loan programs available before making a final decision. Also, establish a good credit history by paying the loan on time. That's why it's good to have an idea about how much one can afford to borrow.

Estimate a student loan payment by using a repayment calculator online. Some links are below.

Links: Jennefer Walsh's Website

Helpful Links: Repayment Calculator | Salary Wizard